how to claim eic on taxes

To claim the EITC taxpayers need to file a Form 1040. Additional Rules for a taxpayer without a.

Earned Income Tax Credit Montanalawhelp Org Free Legal Forms Info And Legal Help In Montana

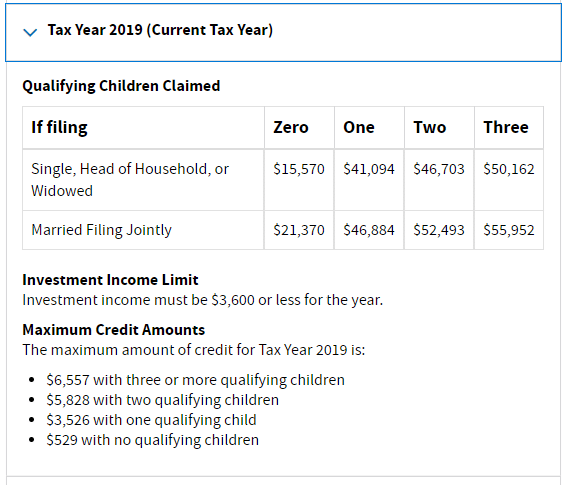

The credit also increases as the number of children claimed on.

. The earned income credit is for certain people who work and have earned income less than 51567. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. Check the box indicating Your Name wishes to elect to use their 2019 earned income to figure their 2021 earned income credit andor child tax credit You will then be asked to enter.

It can boost refunds significantly if you can meet the eligibility guidelines to claim it. Finally if you have one or more kids they have to qualify too for you to receive a larger credit. If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund.

You must not be a dependent of another taxpayer. Not file Form 2555. The EITC is worth between 560 to 6935 in 2022 up from the 2021 EITC of between 543 and 6728.

If you qualify the credit can increase your federal tax refund by up to 5666 depending on your individual tax situation. Taxpayer neglected to mark a box for dependent full time student under age 24 to qualify. If the taxpayer is claiming the EITC with a qualifying child they must also complete and attach the Schedule EIC to.

Please log into the account and follow these steps. You should first claim the EITC on your federal income tax returns. One qualifying child.

Have investment income below 10000 in the tax year 2021. Childless taxpayers have no maximum age limit for tax year 2021. Have worked and earned income under 57414.

If you received a letter from the IRS about the Earned Income Tax Credit EITC also called EIC the Child Tax CreditAdditional Child Tax Credit CTCACTC or the American Opportunity Tax Credit AOTC dont ignore the letter notice. If you file your own taxes make sure to follow the IRS instructions for calculating the EITC carefully. Three or more qualifying children.

The Earned Income Tax Credit EIC is a credit for low to moderate-income taxpayers to get ahead and have more money in their pockets. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. If you dont have a qualifying child you claim the credit on your tax return.

The first step in claiming the tax credit is filing a tax return. If you are not eligible for the federal credit you cannot claim the state credit. You need to complete an IRS Form Schedule EIC Earned Income Credit and file it with your return if youre claiming a qualifying child.

There are strict income thresholds that influence how much the credit might be worth to you. How do you amend your return to claim the earned income tax credit. Claim the credit right on Form 1040 and add Schedule EIC if you have children.

The amount of your credit may change if you have children dependents are. Then your income has to be within stated limits. The taxpayer cannot be a qualifying child of another taxpayer.

The EITC is a refundable federal tax credit for low to moderate income working individuals and families. If you pass all these tests you could get a credit of as much as 6728 for 2021 depending on your income and the number of children you have. You must live in the United States for more than half the year.

The IRS requires paid preparers of federal income tax returns involving the earned income credit. How to claim the EITC. Earned Income Tax Credit eligibility if you have no children.

Citizen or a resident alien all year. All the information you need is in your letter. How much you may get in 2022.

For example if you are employed but your income is considered low by the IRS you may be able. There also are income limits. As established in Publication 596 Earned Income Credit EIC.

President Barack Obama has recommended widening access for even more low-wage childless. For 2020 the income restriction is 15820 for single people and 21710 married filing together once no eligible children are involved. A qualifying child cannot be used by more than one person to claim the EIC.

The amount you can get back from it depends on factors like the number of children who qualify how much you earn and your tax filing status. If you dont have qualifying children Earned Income Tax Credit eligibility is as follows. The earned income tax credit EIC or EITC is for low- and moderate-income workers.

To qualify for the EITC you must. On line 8 subtract the nontaxable amount of the payments from any income on line 8 and enter the result. Follow the directions on your letter.

You may claim the EITC if your income is low- to moderate. To be eligible for the EITC taxpayers need to meet the follow criteria. Even if you dont owe any taxes you will need to file a return in order to claim the credit.

Such messages prevent the return from being e-filed until the preparer completes the expected data. The Maryland earned income tax credit EITC will either reduce or eliminate. The only way to claim the earned income tax credit is to file some sort of tax return so if you havent filed before you wouldnt have had.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. Also include on line 1 any Medicaid waiver payments you received that you choose to include in earned income for purposes of claiming a credit or other tax benefit even if you did not receive a Form W-2 reporting these payments. Have a valid Social Security number by the due date of your 2021 return including extensions Be a US.

A consensus is actually developing to increase accessibility to the earned income credit for childless wage earners. The credit is based on a percentage of your earned income and starts to phase out as you increase your income. See what it is how it works how to qualify.

The earned income tax credit is available to taxpayers with low and moderate incomes. First you have to qualify. Previously it was 65.

Filemytaxes November 2 2021 Tax Credits. But you have to file a tax return to claim the EITC. File 1040X with the IRS and submit correct tax form via mail to the IRS.

Tax filers with children benefit most from the EITC. To qualify for the federal credit you must file as an individual or married filing jointly and be between the ages of 25 and 65 if you have no children.

Irs Notice 797 Possible Federal Tax Refund Due To Earned Income Credit

What Is The Earned Income Credit Check City

How To Claim Earned Income Tax Credit For 2021 Taxes Eitc Youtube

2021 Schedule Eic Form And Instructions Form 1040

Score A Big Tax Refund With The Earned Income Credit Add Thousands To Your Income Tax Refund This Year If You Re Eligible By Tax Refund Income Tax Irs Taxes

Who Qualifies For The Earned Income Tax Credit Shared Economy Tax

Summary Of Eitc Letters Notices H R Block

Earned Income Tax Credit For 2020 Check Your Eligibility

Pin On Organizing Tax Information

Taxpayers Who Expect To Receive An Eic Tax Refund In 2022 Will Have To Wait A Longer Period Of Time

What Is The Earned Income Tax Credit Eitc And Do I Qualify For It Eagle Pass Business Journal

Earned Income Tax Credit Tax Graph Income Tax Tax Credits Income

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Earned Income Tax Credit Guidance 2021 Tax Filings Atlanta Cpa Firm

Form 1040 Earned Income Credit Child Tax Credit Youtube

How To Claim An Earned Income Credit By Electronically Filing Irs Form 8862